As artificial intelligence (AI) continues to integrate into daily life, many investors are re-evaluating their portfolios to align with this transformative trend. One such investor, 25-year-old Michael MacGillivray from Michigan, has taken significant steps in this direction. He remarks, “Whenever you look at AI, it’s like, all roads lead to Nvidia.” This has prompted him to invest thousands of dollars in Nvidia shares this year, reflecting a broader trend among retail investors.

In fact, Nvidia has garnered nearly $30 billion in investments from individual investors in 2024 alone, as reported by Vanda Research. This staggering figure positions Nvidia as the most-purchased stock by retail traders for the year up to December 17, significantly surpassing inflows into the SPDR S&P 500 ETF Trust (SPY), which tracks the overall performance of the U.S. stock market. Nvidia is also poised to overtake Tesla, the previous retail favorite that claimed the title in 2023, with Vanda accounting for net inflows by determining the difference between total inflows and outflows for each security.

A Shift in Popularity

The shift towards Nvidia reflects its impressive performance in the stock market. Senior vice president at Vanda Research, Marco Iachini, states, “Nvidia turned out to be the one stock that kind of stole the show from Tesla because of impressive price gains.”

Nvidia has enjoyed a remarkable year, earning a spot in the prestigious Dow Jones Industrial Average just last month, where it has emerged as the top performer among the index's thirty stocks. Despite a rocky trading environment in December, Nvidia's value is projected to soar by over 180% by the end of the year. This epic rise in share price has elevated Nvidia to an exclusive club of companies with market capitalizations exceeding $3 trillion, making it the second most valuable company in the United States.

Such skyrocketing performance has made Nvidia a prominent feature in the portfolios of individual investors. According to Vanda's data, the average retail trader now holds Nvidia as more than 10% of their portfolio, a marked increase from just 5.5% at the beginning of 2024. As a result, Nvidia is now the second largest holding among retail investors, just behind Tesla. Furthermore, retail inflows into Nvidia this year are over 885% higher than three years ago.

Remarkable Retail Engagement

Gil Luria, head of technology research at D.A. Davidson, observes the rapid ascendancy of Nvidia shares among individual investors. He notes, “Nvidia really stands out in terms of how quickly retail investors became such a big part of the ownership stake.”

Investor Testimonials

Genevieve Khoury, a social media marketer, began purchasing Nvidia shares in 2022 after receiving a recommendation from her father, who works in technology. She plans to hold onto her shares for a future down payment on a home. Khoury reflects on her investment: “It kept going up and up and up. I’m just holding it.”

Seasonal Trends and Price Fluctuations

Interestingly, inflows into Nvidia tend to surge around earnings reports, as noted by Vanda’s Iachini. Retail investors also capitalized on a dip in early August, when broader market conditions prompted sell-offs. However, as the stock price stabilized, Luria notes, “Nvidia shares were more expensive six months ago than in recent sessions.” Despite continued impressive earnings reports, the company’s growth rate has moderated, resulting in a more balanced market position in recent months.

Optimism Persists Among Retail Investors

Even with recent stock price volatility, individual investors like Prajeet Tripathy remain optimistic about Nvidia’s leadership in AI and its ongoing commitment to innovation. “I think that it’s only going to keep rising exponentially,” states Tripathy, a recent college graduate.

The enthusiasm surrounding Nvidia has extended beyond the digital sphere. In August, investors gathered in New York City for a watch party celebrating Nvidia’s earnings report, creating a community around their shared investment interests. This excitement followed Nvidia's 10-to-1 stock split, a move often intended to make shares more accessible for retail investors.

Comparing Market Performances

Despite significant retail ownership, this factor has not driven Nvidia’s price-to-earnings ratio higher to the same extent as companies like Tesla and Palantir. Morningstar equity strategist Brian Colello emphasizes this point, noting, “It’s jaw-dropping at times that such a large company can have such a significant move in stock price on any given day.”

Looking Ahead: The Future of Retail Investment

As 2024 nears, Nvidia has become the standout stock for retail investors, exceeding the S&P 500 ETF Trust in net inflows for the second consecutive year. However, substantial investments in this ETF indicate that investors aren't abandoning safer index funds. Iachini suggests that these trends reflect traders enthusiastic about the ongoing bull market rather than a wholesale move away from traditional investments.

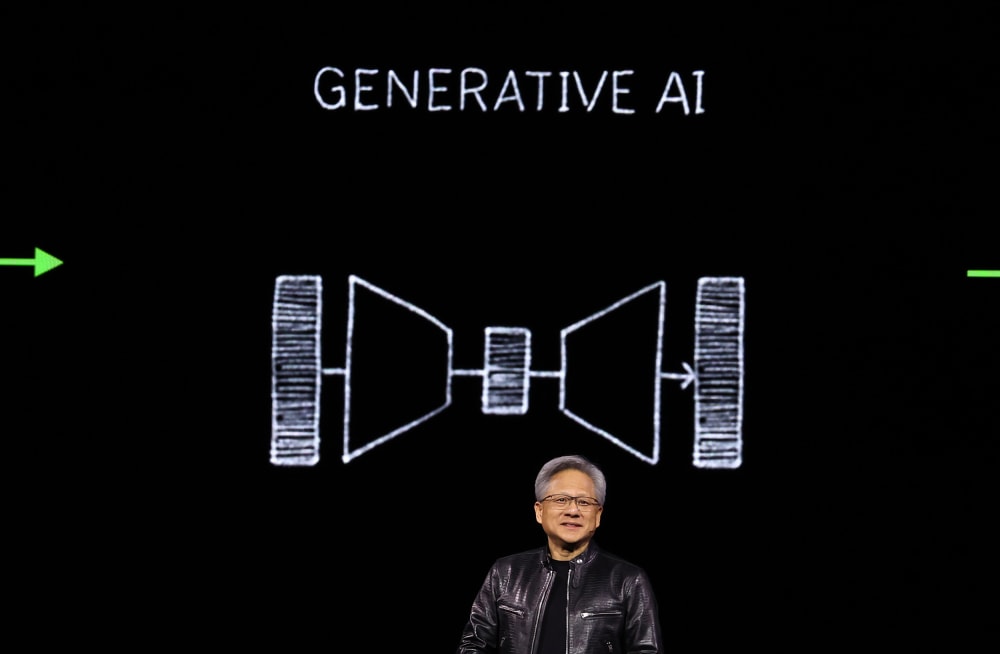

Despite delivering impressive returns, Nvidia may seem an unconventional choice for the name-brand retail investor. Unlike figures such as Tesla’s Elon Musk, who has captivated investors with public personas, Nvidia CEO Jensen Huang lacks a similar presence. However, there’s no shortage of potential future favorites for retail investors. For example, Palantir has gained traction in the fourth quarter and is increasingly popular among retail traders, ranking as the ninth most-purchased stock in 2024, according to Vanda.

Palantir CEO Alex Karp recently expressed appreciation for individual investors in a video set against a snowy backdrop, saying, “Exceedingly grateful to all of you individual investors who took the time and opportunity, and had the courage to look past conventional, rusty, crusty platitudes.”

Genevieve Khoury is one of many who have also made Palantir a part of her portfolio, hoping for a trajectory akin to Nvidia’s. With Palantir’s stock soaring nearly 380% in 2024, Khoury is optimistic she can prove her investment acumen to skeptics, stating, “Multiple times in college, people would try to talk to me about it like I didn’t know what I was talking about.” As she puts it, “Probably, my portfolio looks better than yours.”

In a rapidly evolving financial landscape, staying attuned to market trends and investor sentiments can lead to significant opportunities for both seasoned and novice traders alike. It will be intriguing to observe whether the enthusiasm for Nvidia and other emerging tech stocks will hold as 2024 unfolds.