In recent developments, ByteDance, the parent company of TikTok, is poised to invest heavily in Nvidia chips, aiming to acquire $7 billion worth by 2025. This ambitious plan unfolds despite existing U.S. restrictions designed to limit Chinese companies from purchasing American AI technology.

According to insider reports from The Information, if ByteDance successfully executes this acquisition, it would position the company among the world’s largest owners of Nvidia chips. Such a move would not only solidify ByteDance's status in the tech world but also raise eyebrows regarding U.S. policies and the ever-evolving landscape of international tech trade.

In 2022, the U.S. government enforced stringent export controls on various AI chips, including key technologies from Nvidia, specifically targeting nations like China. These regulations have become increasingly rigorous, reflecting growing concerns surrounding national security, intellectual property, and technological dominance.

ByteDance's Ingenious Strategy

Despite the harsh landscape of restrictions, ByteDance appears to be navigating these regulations through a strategic loophole. Instead of importing the chips directly to China, ByteDance plans to store these advanced components in data centers in other regions, such as Southeast Asia. This approach allows them to technically comply with U.S. laws while still gaining access to crucial AI technologies.

The innovative maneuvering by ByteDance is reminiscent of strategies employed by other tech companies seeking ways to circumvent regulatory barriers. By utilizing data centers outside of their home territory, companies can leverage powerful technologies without directly contravening imposed restrictions.

The South China Morning Post highlighted that ByteDance operates Doubao, touted as China’s leading AI chatbot, which boasts an impressive user base of 51 million active users. This indicates the company’s significant stake in advancing AI capabilities, further emphasizing the relevance of Nvidia’s chips to their operational strategy.

Global Tech Landscape and National Security Concerns

The ongoing battle between the U.S. and China in the tech sector raises critical questions regarding national security and economic resilience. As companies like ByteDance forge ahead, they engage in a broader dialogue about the future of AI, data security, and international collaboration—or lack thereof.

The implications of ByteDance's purchases could resonate beyond the company itself, potentially influencing market dynamics and investor behavior. For example, interest in AI-related technologies is surging, as highlighted in our previous articles discussing Nvidia's impact on retail investors and the evolving landscape of AI development.

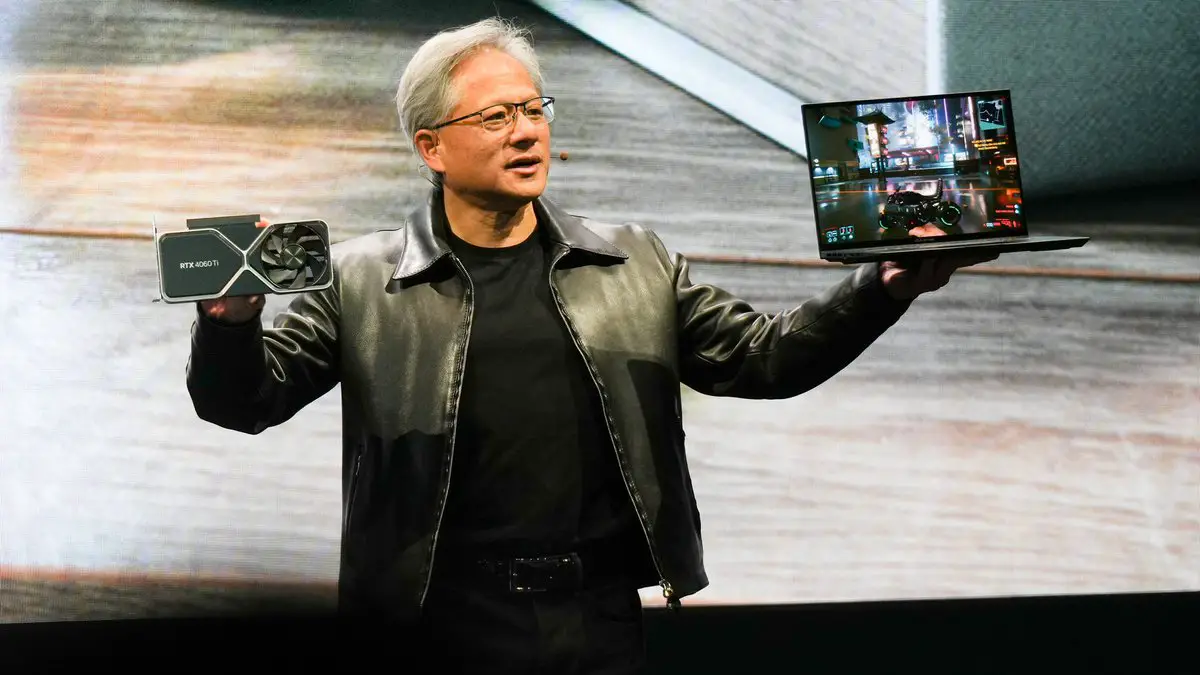

For those looking to dive deeper into the impact of AI-related investments, consider reading our pieces on Nvidia's acquisition of RunAI’s technology and how it affects retail investment trends, as well as our coverage of the keynotes from tech giants during major conferences like CES 2025.

Implications for the Future of AI Technology

ByteDance's pursuit of Nvidia chips may have far-reaching consequences, not just for the company but for the entire AI sector. By acquiring advanced chip technology, they can enhance their AI product offerings, optimize performance, and potentially drive innovation on a larger scale.

The competitive landscape among tech players is intense, and companies equipped with cutting-edge AI technologies are likely to lead the market. This dynamic underscores the importance of closely following developments in regulations and market shifts that may arise as firms navigate the complex web of international trade policies.

To sum up, as ByteDance forges ahead with its plans to secure substantial quantities of Nvidia chips, it will undoubtedly attract scrutiny from policymakers and competitors alike. This strategic acquisition opens up exciting possibilities for innovation while also posing significant questions about the intersection of technology, regulation, and global commerce.

The unfolding story of ByteDance serves as a pertinent reminder of the intricate challenges faced by companies operating in today's tech landscape. The drive to acquire advanced AI technologies persists amid restrictions, showcasing the resilience and adaptability of firms in their quest for growth and success. Keep an eye on further developments regarding ByteDance and Nvidia, as the evolving landscape will certainly influence both companies and the wider tech market.